Universal Credit was introduced as the central plank of a wide

ranging series of Welfare Reforms. This system was introduced by

the 2010 Coalition Government, to make work pay and to encourage

benefit claimants into full time work. Universal Credit combines

the following benefits and tax credits: Jobseeker's Allowance,

Employment and Support Allowance, Income Support, Child Tax Credit,

Working Tax Credit and Housing Benefit into one single monthly

payment. Universal Credit has been rolled out gradually but by May

2016 it had been rolled out nationally to all Jobcentre Plus

offices for single claimants, and is continuing to be expanded to

include all claimant types via the full service.

Since its introduction in April 2013 ARCH and the NFA (National

Federation of Almos) have been monitoring the impact of Universal

Credit on levels of rent arrears of households living in council

owned homes. Our latest analysis reports information as at 30

September 2016, and is the most recent report in the ongoing

research being undertaken jointly by ARCH and the NFA.

Further data will be captured from member local authorities and

ALMOs at the end of March 2017 and will be used to inform the

ongoing dialogue with government departments.

The latest research report published jointly on 16 January 2017

by ARCH and the NFA charts the impact of Universal Credit on the

rent arrears of households living in council owned homes. More than

two and a half years on since its introduction Universal

Credit continues to have a devastating impact on those households

and their ability to maintain rent payments and problems

experienced by Universal Credit claimants have not subsided but

have in fact dramatically worsened.

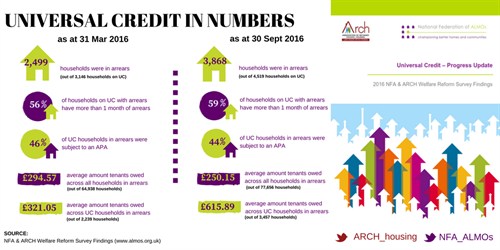

The following infographic highlights the main findings of our

report:

A snapshot of Universal Credit claimants at 30 September 2016

reveal:

- 86% of universal credit claimants living in council owned homes

are in rent arrears (compared to 79% at March 2016

- 59% of universal credit claimants living in council owned homes

have arrears that equate to more than one month's rent

- Although 63% of UC tenants in arrears had pre-existing arrears

before their UC claim only 44% of them are on APAs (alternative

payment arrangements with direct payment from DWP)

- The average value of arrears tenants owed across UC households

has almost doubled to £615 since 31 March 2016 when average amount

was £321.

The report highlights some major concerns for tenants and

council landlords which, unless addressed, will cause major

problems as Universal Credit is rolled out across the

country, John Bibby, ARCH CEO comments:

'We are extremely concerned with the upward trajectory of rent

arrears for universal credit households. Not only are numbers of

households increasing as UC is rolled out, but the percentage of

households falling into rent arrears and experiencing financial

difficulty is critically high. If this trend is not reversed it

will have significant impact on local authorities' rental income

streams and the long term ability for housing departments to

provide essential services to their communities. Together with the

NFA we continue to hold regular conversation with the DWP to find

ways to resolve the problems currently being experienced by

claimants.'

The Report and its findings has been submitted to the Department

of Works & Pensions and in ongoing talks with Caroline Nokes MP

(Department of Works & Pensions successor to Lord Freud

responsible for overseeing the implementation of Universal Credit)

ARCH and the NFA will continue to lobby for an end to the seven day

waiting period for Universal Credit claims.

Click here for a full copy of the

ARCH/NFA Report "Universal Credit - Progress Report" published on

16 January 2017

Publication of the Report has attracted significant media

interest and has featured in Inside Housing and other publications

including the Local Government Chronicle and 24Housing